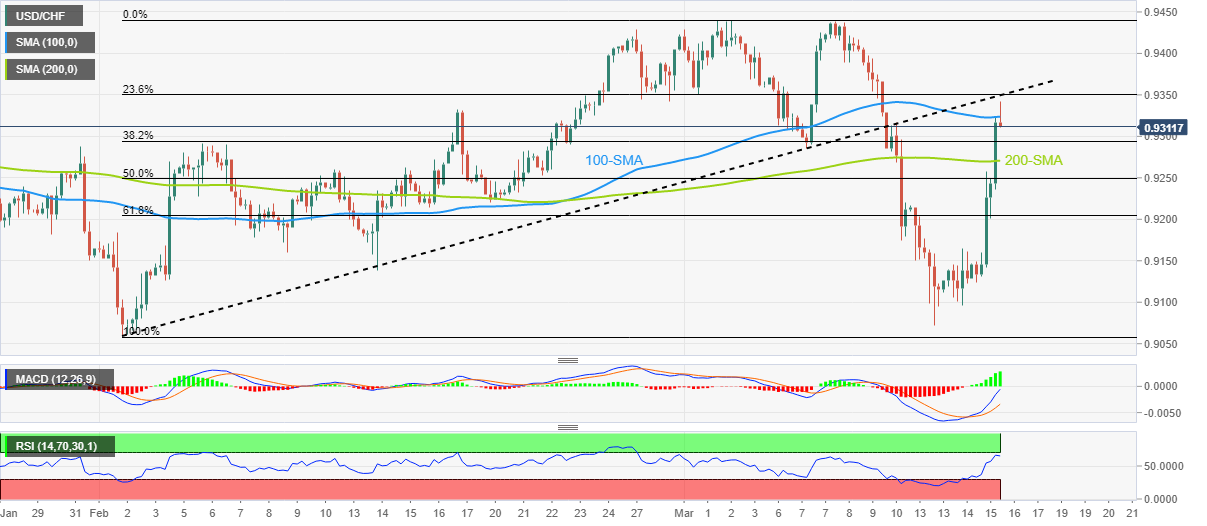

USD/CHF Price Analysis: Retreats towards 0.9300 as 100-SMA, support-turned-resistance tease bears

- USD/CHF eases from the one-week high to pare the previous day’s heavy gains.

- Nearly overbought RSI favors pullback from 100-SMA, six-week-old previous support line adds to the upside filters.

- 200-SMA holds the key to the further downside; bullish MACD signals also test Swiss currency pair sellers.

USD/CHF drops to 0.9313 as bulls take a breather during active trading hours of early Thursday, following a stellar run-up during the previous day.

In doing so, the Swiss currency pair retreats from the 100-bar Simple Moving Average (SMA) amid the overbought RSI conditions. Adding strength to the latest pullback could be the global policymakers’ recent announcements to tame the financial market risks, especially after the Credit Suisse turmoil.

Also read: Forex Today: Dollar and Yen jump as panic takes over markets

It’s worth noting, however, that the bullish MACD signals challenge the USD/CHF bears, which in turn highlights the importance of the 200-SMA level of 0.9270 as the key support. That said, the pair sellers also need validation from the 0.9300 immediate support.

In a case where USD/CHF breaks the 200-SMA support, the odds of witnessing a slump towards the 50% and 61.8% Fibonacci retracement levels of February-March run-up, respectively near .9250 and 0.9200, can’t be ruled out.

Alternatively, the 100-SMA and the previous support line from early February, close to 0.9325 and 0.9350 in that order, restrict short-term USD/CHF upside.

Following that, a run-up towards crossing the double tops near 0.9435-40 appears more likely.

To sum up, USD/CHF is expected to pare recent gains but the downside room seems limited.

USD/CHF: Four-hour chart

Trend: Limited downside expected