When is the German IFO survey and how it could affect EUR/USD?

The German IFO Business Survey overview

The German IFO survey for February is due for release later today at 0900 GMT. The headline IFO Business Climate Index is seen a tad weaker at 95.3 versus 95.9 previous.

The Current Assessment sub-index is seen arriving at 98.6 this month, while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to come in at 92.2 in the reported month vs. 92.9 last.

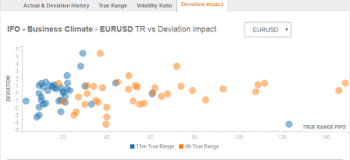

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 40 pips in deviations up to 2.4 to -3.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

According to Haresh Menghani, Analyst at FXStreet, “From a technical perspective, the pair managed to rebound from support marked by the lower end of over one-year-old descending trend-channel. Meanwhile, the attempted recovery faltered ahead of the 1.0870-75 intermediate resistance zone, which should now act as a key pivotal point for short-term traders. Above the mentioned hurdle, a fresh bout of a short-covering move now seems to assist the pair to surpass the 1.0900 round-figure mark.”

“On the flip side, bearish traders are likely to wait for a sustained break below the trend-channel support, currently near the 1.0775-70 region. A convincing breakthrough will confirm a fresh bearish breakdown and the pair then might accelerate the fall further towards testing the 1.0700 round-figure mark,” Haresh adds.

Key notes

EUR/USD: German IFO to drive the day

EUR Futures: Scope for extra gains

Huge weekend stocks gap on Italy coronavirus, gold at $1680

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).